Divestment of two newly developed residential properties in Botkyrka, Stockholm

- Price: Undisclosed

- Area: 9,900 m²

- Buyer: Acer Bostad (OTPP/Gordion Capital) (CA/SE)

- Sole financial adviser to Reliwe and Derome (SE)

Financing of Sello Shopping Centre in Espoo. The €200 million term loan was provided by OP Financial Group (FI) and SEB (SE).

- Sole financial adviser to Keva (FI), Elo (FI) and Ilmarinen (FI)

Divestment of logistics and storage property in Stavanger

- Price: Undsiclosed

- Area: 8,300 m²

- Buyer: Høyland Kapital AS (NO)

- Sole financial adviser to Tøffa AS (NO)

Divestment of office property in Sundsvall

- Price: Undisclosed

- Area: 2,600 m²

- Buyer: Diös (SE)

- Sole financial adviser to SKIFU (Sundsvall Municipality) (SE)

Divestment of Kongahälla Shopping Center in Kungälv

- Price: Undisclosed

- Area: 40,000 m²

- Buyer: Alecta (SE)

- Sole Financial Advisor to Alecta (SE) and Adapta (SE)

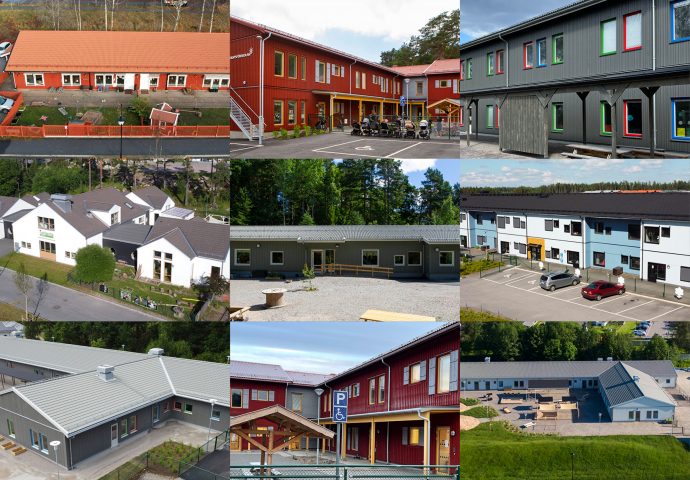

Divestment of 11 preschools across Sweden

- Price: SEK 515 million

- Area: ~9,600 m²

- Buyer: Kinland (NO)

- Sole financial adviser to Svenska Samhällsfastigheter (SE)

Joint venture between AKF, Sampension, and Brøndby Municipality for the development of Fremtidens Brøndby Strand

- Area: ~300,000 m²

- Commercial adviser to Fremtidens Brøndby Strand P/S (DK)

Divestment of omnichannel retail and warehouse property in Helsinki

- Price: EUR 12.2 million

- Area: 6,800 m²

- Buyer: Stendörren Fastigheter (SE)

- Sole financial adviser to Terrieri Kiinteistöt (managed by S-Bank Fund Management Ltd) (FI)

Divestment of two residential properties with 318 apartments in Kalmar and Växjö

- Price: SEK 676 million

- Area: 21,600 m²

- Buyer: Bonäsudden Holding AB (SE)

- Sole financial adviser to Smålandsvist (SE)

Joint venture between Freja Ejendomme, Realdania, and Odense Municipality for the development of Gl. Odense Universitetshospital

- Area: ~274,000 m²

- Commercial adviser to Freja Ejendomme (DK)

Forward funding divestment and tenant search of a serviced apartment project in Copenhagen

- Price: Undisclosed

- Area: 4,278 m²

- Buyer: Swiss Life Asset Managers (CH)

- Seller: AG Gruppen (DK)

- Financial adviser to AG Gruppen (DK)

Divestment of office property Näckström 6 and conference facility Täcka Udden in central Stockholm

- Price: SEK 1.4 billion

- Buyer: FAM AB (SE)

- Sole Financial Advisor to Vectura (SE)